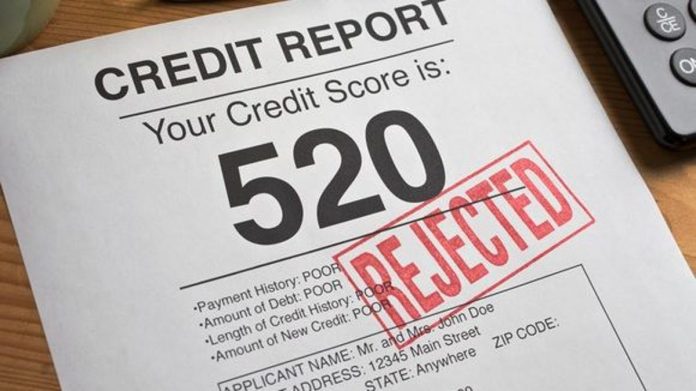

Do you suffer from bad credit? Many times when we are younger, we make bad financial decisions without understanding the long term harm. The long term harm is bad credit and the consequence is having a hard time getting a credit card, getting a home loan, or getting a car loan.

Credit card companies run a credit background check before issuing a credit card. Based on your credit card rating, they will issue you a card or decline you. If you suffer from bad credit, you should research credit cards that will allow a lower credit standing.

Below are 5 credit cards that you can get even with a poor credit score:

Discover It Secured card

The best credit card for bad credit is the Discover it Secured card. This secured credit card has a $0 annual fee and provides around 2% cash back on purchases. Cardholders earn 2% money back on $1,000 spent at gasoline stations and restaurants every quarter. Additionally, you can save 1% back on all other purchases. Discover also doubles all of the benefits earned the very first year.

Credit One Bank® Platinum Visa®

Some people find themselves in the position of having to borrow money while trying to fix their credit. For these individuals the ideal credit card for bad credit with no deposit is the Credit One Bank® Platinum Visa® for Rebuilding Credit. The annual fee is $0 – $99, based on an applicant’s credit. In exchange you will receive a $300 starting credit limit. It is the lowest available unsecured credit card for poor credit.

OpenSky® Secured Visa® Credit Card

Credit card shoppers that need a credit card for bad credit without a credit check can apply for the OpenSky® Secured Visa® Credit Card. Even applicants with a very bad track record borrowing have high acceptance chances. The OpenSky® Secured Visa® Credit Card includes a $35 annual fee and requires a refundable security deposit of $200.

Green Dot Visa® Secured Credit Card

Anybody with less than perfect credit and no bank accounts should consider the Green Dot Visa® Secured Credit Card. Approved applicants may finance their $200 + deposit by mailing a check or money order or paying cash at a participating merchant. The Green Dot Visa® Secured Card includes a $39 annual fee.

Indigo® Mastercard®

Individuals whose bad credit is in fact not so poor should think about the Indigo® Mastercard®. The card’s annual fee is $0 – $99, depending upon your credit. Meaning the better your credit is, the lower the annual fee is likely to be. Additionally, the Indigo Mastercard is unsecured, and therefore you don’t need to put a deposit.

Generally, the best credit cards for bad credit are secured cards with no annual fee. That is true for everybody with bad credit. The very best unsecured credit cards still charge an arm and a leg for a rather modest amount of borrowing ability. With bad credit, you have to see which of these five options are best for you. Once you figure that out and are approved, you should slowly work towards rebuilding your credit.